What 2020 Taught Us About The Stock Current market

getty

2020 was brutal in numerous strategies:

- Approximately400,000 People in america were being killed by COVID-19.

- Unemployment peaked at 14.7%, the maximum given that the Excellent Despair.

- Hundreds of hundreds of businesses failed, and overall industries, this kind of as journey and dining places, had been devastated.

- GDP contracted at a amazing 31.4% annualized charge in the next quarter, and the full-year GDP for 2020 was a unfavorable 3.5%, the worst yr considering that World War II.

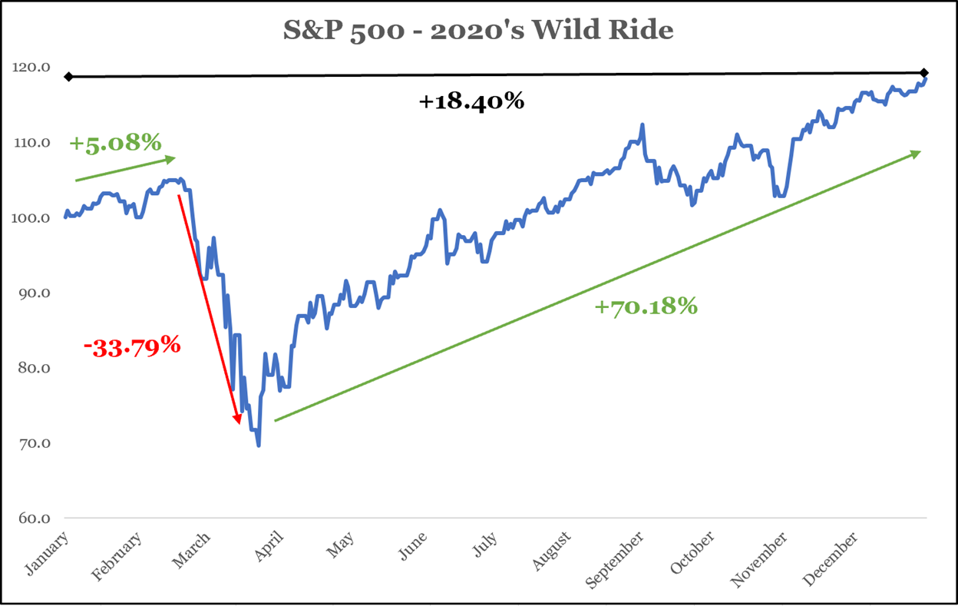

Despite all this bad information, the inventory sector experienced a fantastic year. Following enduring the speediest 30% fall in background, the S&P 500 rebounded 70%, ending the year with an 18.4% full return.

Credit rating: The St. Louis Belief Company Details from Morningstar

What can we discover from this? 2020 emphatically verified two elementary principles of the inventory market place.

Basic principle 1: The foreseeable future is impossible to forecast

On December 31, 2019, I was at a party at a condominium in Vail and expended the 1st 7 days of the year skiing. I was wanting ahead to an additional attractive 12 months – a steadily growing organization, holidays and travel, and a comprehensive social life. Wondering again to that 7 days is unnerving simply because I had no idea what was coming.

As we glimpse forward to 2021, we do not have any greater strategy of what the future retains than we did a yr back. That uncertainty will make us not comfortable, so gurus keep forecasting inventory marketplace returns to soothe us. As I a short while ago wrote in my write-up What Will The Stock Marketplace Return in 2021, we really should dismiss professional predictions because they are only at any time right by accident, and they are furthest off the mark when we require them most.

Basic principle Two: The inventory current market is not the economic climate

That the economy is tanking or booming doesn’t mean the inventory marketplace will do the exact. 2020 confirmed that the financial system and the stock industry can head in unique instructions.

In March of 2020, I posted an report in Forbes titled Why The Looming Economic downturn Doesn’t Indicate You Ought to Market Out Of The Stock Market, creating the stage that the stock market is not the economic system and that the two only correlate incredibly weakly. So the economic climate moving into a recession didn’t portend that stock returns would be poor. Due to the fact that post was revealed, the stock market has attained 45%, and individuals have asked me how I understood it had bottomed. The question misses the level: I didn’t know what the market place would do. It went up. It could have absent down. I didn’t know. And I even now really don’t.

The Inventory Marketplace is A Advanced Adaptive Technique

In July 2020, I released the report Why The Stock Sector Does not Make Any Sense which describes that the stock market place is a advanced adaptive procedure. Viewing the marketplace this way explains why it can be up when a pandemic is raging and why it’s difficult to forecast what it will do.

In a elaborate adaptive technique, knowledge every single part doesn’t assistance us have an understanding of the final results of the process as a entire. System-level outcomes are usually bigger than the sum of the pieces due to the fact the procedure is composed of heterogeneous actors (named agents) who interact with each individual other in methods that are not able to be predicted. In a complex adaptive method, agents discover and change their behavior—sometimes rationally and sometimes irrationally—as instances modify. Their altering behavior can build responses loops as the output from a single outcome gets to be the input to the upcoming iteration. Detrimental opinions typically generates security, whilst constructive feedback can amplify little steps into big and unanticipated gatherings. Favourable comments loops create technique-extensive outcomes that are not able to be predicted by observing the personal actions of the brokers.

Placing the Rules into Follow

It’s disconcerting that we simply cannot know what will materialize in the inventory market place because we have advanced to appear for styles that aid us predict the potential. It is a person of our fundamental survival mechanisms.

On the other hand, it is liberating to comprehend that there is no point in minutely pursuing the current market and reacting to just about every piece of news. It is important to embrace the uncertainty and keep a significant photo check out if you want to make investments properly.

Here’s a tale that illustrates why. For the duration of the very first 7 days of March 2020, I had my very last confront-to-experience shopper conference. At that place, the stock industry was in totally free drop, and my consumer was seeking not to panic. At some point in the discussion, she made the level that “nobody could see this coming.” I told her that I had been adhering to the pandemic closely even though it was even now in China and experienced read article content by infectious illness authorities that predicted it would make its way to the U.S. and distribute. So, we did have some progress warning. She looked at me incredulously and asked, “Well, then why did not you do anything? Why did not you have us sell out of the sector?” I instructed her that we did not recommend clients to market out of the marketplace due to the fact we would not know when to tell them to get back in the market place. It was likely that by likely to income, our customers would miss out on the rebound when it came. Once you are in cash, it is a large amount more difficult psychologically to set it to get the job done when issues are scary than it is to remain invested. Factors turned out effectively for her and our other clients. They did not provide out of the sector, and they absolutely participated in the market’s wonderful restoration.