Rising rates raise prospect of property crash

[ad_1]

Brenda McKinley has been advertising properties in Ontario for much more than two decades and even for a veteran, the previous couple of years have been surprising.

Prices in her patch south of Toronto rose as a great deal as 50 for every cent throughout the pandemic. “Houses had been advertising practically ahead of we could get the indication on the garden,” she said. “It was not strange to have 15 to 30 offers . . . there was a feeding frenzy.”

But in the past six months the market has flipped. McKinley estimates residences have drop 10 per cent of their benefit in the time it might choose some buyers to complete their acquire.

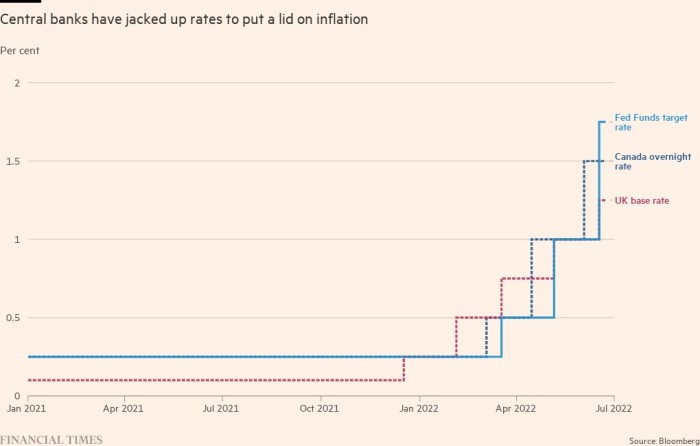

The phenomenon is not one of a kind to Ontario nor the household sector. As central banking companies jack up interest costs to rein in runaway inflation, house traders, home owners and professional landlords all-around the environment are all asking the exact same dilemma: could a crash be coming?

“There is a marked slowdown everywhere,” claimed Chris Brett, head of funds marketplaces for Europe, the Middle East and Africa at residence company CBRE. “The adjust in expense of debt is acquiring a significant affect on all markets, across everything. I really do not feel nearly anything is immune . . . the velocity has taken us all by surprise.”

Mentioned assets shares, closely monitored by traders hunting for clues about what could possibly finally take place to much less liquid actual belongings, have tanked this yr. The Dow Jones US Authentic Estate Index is down pretty much 25 per cent in the yr to date. British isles house shares are down about 20 for every cent over the exact same period, falling additional and more rapidly than their benchmark index.

The number of business purchasers actively looking for property across the US, Asia and Europe has fallen sharply from a pandemic peak of 3,395 in the fourth quarter of last yr to just 1,602 in the second quarter of 2022, in accordance to MSCI details.

Pending promotions in Europe have also dwindled, with €12bn in agreement at the stop of March against €17bn a 12 months previously, according to MSCI.

Deals already in coach are staying renegotiated. “Everyone providing all the things is getting [price] chipped by possible customers, or else [buyers] are going for walks absent,” explained Ronald Dickerman, president of Madison Global Realty, a private fairness firm investing in assets. “Anyone underwriting [a building] is owning to reappraise . . . I cannot more than-emphasise the sum of repricing likely on in real estate at the moment.”

The cause is uncomplicated. An trader prepared to shell out $100mn for a block of apartments two or a few months back could have taken a $60mn home finance loan with borrowing prices of about 3 for each cent. These days they might have to spend a lot more than 5 per cent, wiping out any upside.

The go up in rates usually means buyers have to possibly take decreased over-all returns or press the vendor to decreased the value.

“It’s not nonetheless coming by means of in the agent data but there is a correction coming via, anecdotally,” stated Justin Curlow, world-wide head of investigation and approach at Axa IM, a person of the world’s biggest asset professionals.

The dilemma for property buyers and proprietors is how common and deep any correction could be.

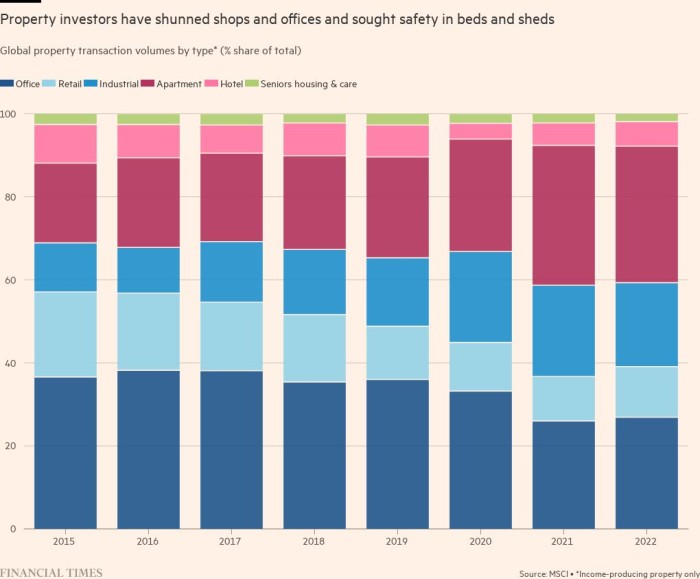

Through the pandemic, institutional buyers performed defence, betting on sectors supported by secure, prolonged-term demand. The value of warehouses, blocks of rental flats and places of work outfitted for lifetime sciences businesses duly soared amid intense levels of competition.

“All the massive buyers are singing from the similar hymn sheet: they all want household, urban logistics and substantial-quality workplaces defensive assets,” claimed Tom Leahy, MSCI’s head of real belongings analysis in Europe, the Center East and Asia. “That’s the issue with true estate, you get a herd mentality.”

With hard cash sloshing into tight corners of the residence market, there is a risk that belongings were being mispriced, leaving minor margin to erode as charges increase.

For homeowners of “defensive” properties acquired at the leading of the market who now want to refinance, level rises create the prospect of entrepreneurs “paying additional on the loan than they expect to receive on the property”, explained Lea Overby, head of industrial home loan-backed securities investigate at Barclays.

Ahead of the Federal Reserve began raising prices this calendar year, Overby believed, “Zero per cent of the market” was influenced by so-referred to as adverse leverage. “We really do not know how significantly it is now, but anecdotally its relatively prevalent.”

Manus Clancy, a senior taking care of director at New York-based mostly CMBS details service provider Trepp, claimed that even though values have been unlikely to crater in the far more defensive sectors, “there will be a lot of fellas who say ‘wow we overpaid for this’.”

“They assumed they could improve rents 10 per cent a year for 10 several years and costs would be flat but the shopper is currently being whacked with inflation and they just can’t go on expenditures,” he additional.

If investments regarded as positive-hearth just a couple of months in the past search precarious riskier bets now look toxic.

A increase in ecommerce and the shift to hybrid function through the pandemic left homeowners of places of work and shops exposed. Mounting costs now threaten to topple them.

A paper revealed this thirty day period, “Work from dwelling and the business real estate apocalypse”, argued that the overall price of New York’s places of work would in the long run drop by almost a third — a cataclysm for owners including pension money and the governing administration bodies reliant on their tax revenues.

“Our view is that the total office stock is truly worth 30 for every cent fewer than it was in 2019. Which is a $500bn strike,” stated Stijn Van Nieuwerburgh, a professor or real estate and finance at Columbia College and a person of the report’s authors.

The drop has not nonetheless registered “because there is a quite significant phase of the business office market place — 80-85 per cent — which is not publicly listed, is quite untransparent and where by there’s been very small trade”, he included.

But when older workplaces alter hands, as resources appear to the conclusion of their life or proprietors wrestle to refinance, he expects the savings to be intense. If values fall considerably ample, he foresees adequate mortgage defaults to pose a systemic threat.

“If your bank loan to benefit ratio is higher than 70 for every cent and your worth falls 30 for each cent, your house loan is underwater,” he claimed. “A great deal of offices have extra than 30 per cent home loans.”

According to Curlow, as substantially as 15 per cent is presently being knocked off the price of US workplaces in remaining bids. “In the US workplace sector you have a bigger amount of vacancy,” he mentioned, adding that America “is floor zero for fees — it all commenced with the Fed”.

United kingdom office environment house owners are also getting to navigate shifting functioning patterns and growing rates.

Landlords with present day, strength-economical blocks have so considerably fared comparatively nicely. But rents on more mature structures have been hit. Property consultancy Lambert Smith Hampton prompt this 7 days that extra than 25mn sq ft of United kingdom office space could be surplus to requirements immediately after a study located 72 for each cent of respondents ended up wanting to reduce again on office environment place at the earliest prospect.

Hopes have also been dashed that retail, the sector most out of favour with buyers coming into the pandemic, could appreciate a recovery.

Massive United kingdom buyers including Landsec have bet on browsing centres in the past six months, hoping to catch rebounding trade as folks return to physical stores. But inflation has knocked the recovery off training course.

“There was this hope that a lot of procuring centre owners had that there was a stage in rents,” reported Mike Prew, analyst at Jefferies. “But the rug has been pulled out from beneath them by the value of dwelling crisis.”

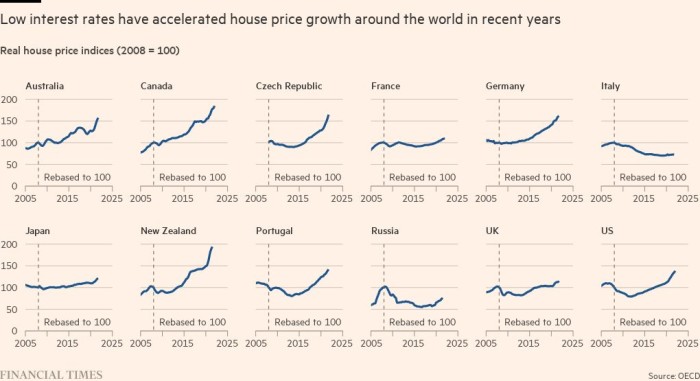

As premiums rise from extremely-reduced ranges, so does the risk of a reversal in household markets the place they have been soaring, from Canada and the US to Germany and New Zealand. Oxford Economics now expects selling prices to drop up coming yr in those marketplaces where by they rose quickest in 2021.

Various buyers, analysts, agents and residence homeowners advised the Fiscal Instances the danger of a downturn in residence valuations experienced sharply improved in current weeks.

But number of expect a crash as serious as that of 2008, in part because lending practices and hazard appetite have moderated given that then.

“In common it feels like commercial serious estate is set for a downturn. But we experienced some potent progress in Covid so there is some space for it to go sideways ahead of impacting nearly anything [in the wider economy],” said Overby. “Pre-2008, leverage was at 80 for every cent and a good deal of appraisals ended up pretend. We are not there by a very long shot.”

According to the head of a single large genuine estate fund, “there’s undoubtedly pressure in scaled-down pockets of the market but that is not systemic. I really do not see a whole lot of people saying . . . ‘I’ve committed to a €2bn-€3bn acquisition making use of a bridge format’, as there ended up in 2007.”

He additional that while far more than 20 businesses appeared precarious in the run-up to the fiscal crisis, this time there had been possibly now 5.

Dickerman, the non-public fairness trader, believes the overall economy is poised for a extended period of time of discomfort reminiscent of the 1970s that will idea true estate into a secular drop. But there will nonetheless be successful and losing bets because “there has hardly ever been a time investing in genuine estate when asset classes are so differentiated”.

[ad_2]

Source hyperlink