PassportCard Nomads Travel Insurance Review

Scan our PassportCard Nomads review to discover the benefits and drawbacks of this innovative new travel insurance company. See for yourself if it’s the right travel insurance choice for you!

In our 12 years of writing about travel, it’s rare that there’s something new in the travel insurance space. We’ve talked in detail about travel insurance options for short term vacationers, long term travelers, and even expats, and covered most of the major companies in the travel insurance space.

However, in this article we’re looking at a new approach to travel insurance from PassportCard Insurance. PassportCard global nomad insurance is innovative because it’s a fully app-based travel service.

Personally, we never take at trip without making sure we have travel insurance in place.

We’ve had a couple of situations where we’ve needed travel insurance: once when I ended up in the hospital for three days in Thailand, and once where our son was injured in Greece.

We’re both ok now, but they were stressful situations, and having travel insurance meant that we didn’t need the additional worry of a pricey, unexpected medical bill. See our “Do I need travel insurance?” article for more.

Getting reimbursed for travel insurance is a hassle

One of the main hassles with using travel insurance is that many insurers require you to pay out of pocket to get treated. You’re then paid back when you file a claim. As you can imagine, this is pretty stressful, and especially concerning if you’re low on funds.

When our son cut his eye on a piece of playground equipment in Greece, we were forced to pay out of pocket for expensive private medical care, as that was all that was accessible. We then had to consider getting a reimbursement from the travel insurance company after the fact. We were lucky that it was only a few hundred Euro.

There must be a better way.

That’s where PassportCard Nomads comes in.

PassportCard Nomads Insurance Review

PassportCard Nomads is basically a travel insurance credit card that lets you you use an app to access and manage your travel insurance.

In an emergency, follow three quick steps to use the card:

- Open the app.

- Choose the service you need (money is added to your card to be used immediately).

- Use the card to pay for medical care.

All you need to do is swipe the red card and PassportCard Nomads pays for medical care.

That’s where this insurance is different. PassportCard says it’s is the only insurer that settles claims in real time, possibly within minutes.

You can extend or cancel anywhere, or any time.

To get prices, and learn more about plans and details, get a quote on the Passport Card Nomads website here.

Who is PassportCard Nomads insurance for?

PassportCard Nomads insurance is mostly aimed to digital nomads and remote workers who are away from their home country who want to get expat travel insurance.

It’s generally aimed at for younger vacationers and long term travelers (but they do have a plan that will cover up to age 65).

How does PassportCard Nomads work?

PassportCard is a prepaid card which pays for your medical services. Just load it via the app, no questions, no paperwork, no hassle.

To get PassportCard insurance, go to their website and purchase a plan. (There are details on the plans they offer later in this post.)

They’ll ship your personal, physical, red Nomads Card within seven business days of purchasing your policy.

Sign into the app, and finish setting up your account and preferences.

If you need to make a claim, open the app, request funds, and pay for your medical service with the card.

What are the potential drawbacks?

Because PassportCard nomads works like a regular credit card, it should work in all countries in the world. There are a few areas of the world where the VISA network doesn’t work; sanctioned countries for example.

There’s also the small chance that the VISA network is down, due to technical problems. In either case, you’d just need to pay out of pocket, and get reimbursed later, just like regular travel insurance.

Because Passport Card Nomads insurance is app based, you may also run into a problem if you can’t access the app.

IF you’re in a place where there’s no data or Wi-Fi, you won’t be able to access the app to add funds for your emergency. Similarly, if something catastrophic happens, and you could be so badly sick or hurt that you can’t use the app to add funds.

If there isn’t Wi-Fi available, or you can’t use the app for some other reason to add funds, then you’ll have to pay up front and get reimbursed later, just like with other travel insurance policies.

Generally, I’d guess that the likelihood of any of these happening is extremely low. Even if they do happen, you’re still covered by reimbursement for your up-front costs, just like other travel insurance policies.

PassportCard Nomads coverage doesn’t automatically lost luggage. If you’re looking for baggage cover, you may need to get that separately.

However, you can get an add-on for theft of camera or laptop, or optional coverage for baggage and personal items.

How much does PassportCard insurance cost?

Plans start at $59 a month.

What plans are offered?

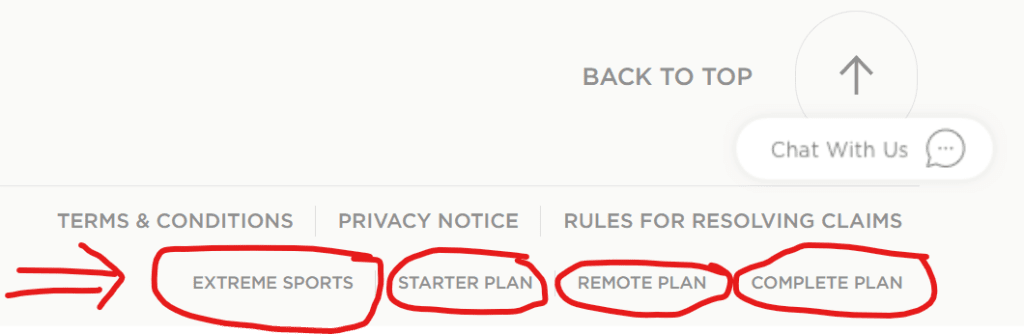

PassportCard offers three plans, all of which come with a red travel insurance card:

- Starter – for short term travelers up to 6 months

- Remote – an extended plan for up to 12 months

- Complete – for those who have settled down and relocated to their chosen destination

Starter Plan

The Starter plan starts at $59/month.

It’s recommended for travelers that have a home base, and travel occasionally.

Deductible: 0

Age: 18-45

Coverage: up to $500,000 per policy period

You can customize the Starter plan by adding loss of baggage, extreme sports, theft of laptop or camera, and more.

The Starter plan does not cover travel in the USA.

Remote Plan

The Remote plan starts at $119/month.

This plan is recommended for longer term travelers and remote workers. It includes annual checkups and outpatient cover.

Deductible: 0

Age: 18-45

Coverage: up to $1,000,000 per policy period

You can customize the Remote plan by adding loss of baggage, extreme sports, theft of laptop or camera, and more.

The Remote plan does not cover travel in the USA.

Complete Plan

The Complete plan starts at $200/month.

The Complete plan is the only plan that covers nomads travelling to the USA. It also includes emergency medical care, elective care and has wellness benefit plan.

Deductible: varies

Age: Up to 65

Coverage: up to $3,500,000 per policy period

You can customize the Complete plan.

Where in the world am I covered?

If you want coverage to the USA, you’ll need to choose the Complete Plan, which is the only plan that includes cover in the USA.

The Standard and Remote plans include coverage to almost every country in the world except the USA.

You can add an extended medical insurance coverage for the following countries, which are not part of the default cover: UK, China, Hong Kong, Taiwan, Brazil, Singapore, Switzerland.

What happens if I don’t have my card?

The policy is active with or without the card.

The advantage of the card is that it is loaded with funds to pay the medical expenses. If you pay by yourself, Passport Nomads reimburses your credit card or bank account.

Can you buy PassportCard Nomads insurance abroad?

Yes, you can buy PassportCard Nomads insurance while you’re abroad.

Is there a deductible?

There’s no deductible for the Starter and Remote Plans. The deductible varies with the Complete Plan, depending on the options you choose.

Can I extend my insurance while on my trip?

Yes. You can extend or cancel.

Is COVID-19 coverage included?

COVID-19 cover is included.

All three plans cover inpatient treatment in case of infection under the policy, subject to the specific plan you purchase, and the details of the plan. See your specific policy for details.

The PassportCard Nomads site says “COVID-19 detection tests will also be considered a medical expense in circumstances that justify testing in case of suspicious symptoms or clear exposure to a patient diagnosed with Coronavirus“.

Do I need to use the PassportCard doctors?

You aren’t required to pick a doctor recommended by PassportCard Nomads. However, they can connect you with multilingual medical experts if you’d like.

What does the app do?

You’ll need the app to load the card with funds, search for healthcare providers nearby, manage claims and view health plan benefits.

The app is available on Google Play and the App Store for iPhone and iPad.

Here’s a bit more on the app from the PassportCard Nomads YouTube channel.

Who is the underwriter?

The underwriter is DavidShield Insurance Company Ltd.

Need more details?

Because travel insurance policies can change without warning, look over the insurance policy before you buy. You can find links to specific policies in the footer of the PassportCard Nomad website, shown below.

To get prices, and learn more about plans and details, get a quote on the Passport Card Nomads website here.