Klobuchar targets Big Tech with most important antitrust overhaul in 45 several years

With a new session of Congress underway and a new administration in the White Dwelling, Huge Tech is after all over again in lawmakers’ crosshairs. Not only are important firms these types of as Apple, Amazon, Facebook, and Google beneath investigation for allegedly breaking present antitrust law, but a recently proposed invoice in the Senate would make it more durable for these and other corporations to become so troublingly substantial in the very first place.

The bill (PDF), called the Opposition and Antitrust Law Enforcement Reform Act (CALERA for short, which is still awkward) would come to be the largest overhaul to US antitrust regulation in at minimum 45 decades if it grew to become legislation.

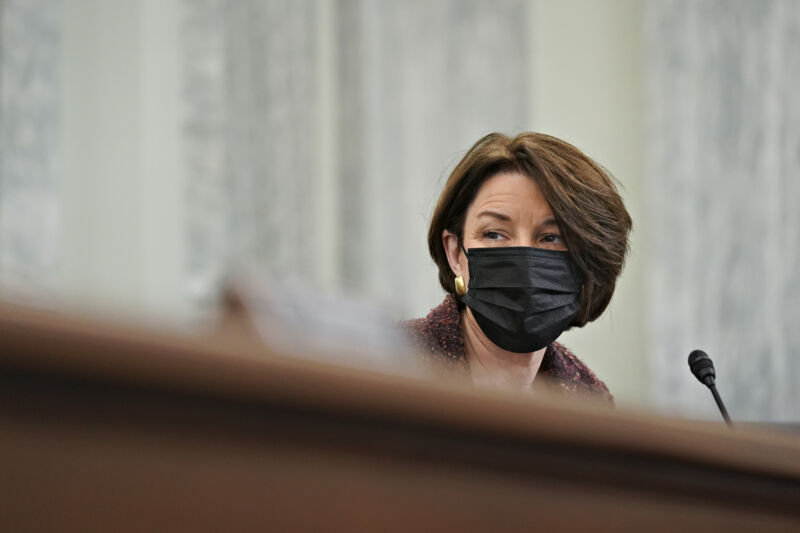

“While the United States after had some of the most efficient antitrust laws in the world, our overall economy today faces a significant competitors problem,” claimed Sen. Amy Klobuchar (D-Minn.) when she introduced the invoice on Thursday. “We can no for a longer time sweep this issue under the rug and hope our current legislation are satisfactory,” Klobuchar extra, contacting the monthly bill “the to start with move to overhauling and modernizing our regulations” to guard competitiveness in the present-day period.

The monthly bill proposes drastically expanded assets (i.e., extra cash) for the Federal Trade Commission and the Antitrust Division at the Section of Justice, to enable the two to be able to go after evaluate of a lot more mergers far more aggressively. As Klobuchar put it to CNBC, “You can not consider on trillion-greenback organizations with Band-Aids and duct tape.”

Additional importantly, even so, the proposed regulation would invoke modern-day authorized theories to update antitrust legislation for the way organizations do and will not compete with just about every other in the 21st century.

Sens. Richard Blumenthal (D-Conn), Cory Booker (D-N.J.), Edward Markey (D-Mass.), and Brian Schatz (D-Hawaii) co-sponsored the bill, which firmly targets the tech sector without the need of actually naming it at all.

What does antitrust regulation do?

There have been four big antitrust costs so much in US heritage, all of which are aimed at avoiding a one company from using unfair techniques to dominate its industry sector and squash potential rivals.

Congress’s first stab at antitrust enforcement, the Sherman Act, grew to become legislation in 1890. The Sherman Act was shockingly brief and very simple, producing it unlawful to monopolize, try to monopolize, or conspire to monopolize a market place. As soon as that baseline was established, the legal guidelines that adopted have attempted to deal with all the techniques businesses have tried to work all-around it.

In 1914 the Clayton Act elaborated appreciably on existing antitrust legislation, in large aspect to deal with the hurry of acquisitions and development of firms that flowed in the wake of the Sherman Act. That regulation put limitations on acquisitions through stock purchases but left a giant loophole for corporations that acquired other firms by purchasing their assets outright.

The upcoming important antitrust overhaul, the Celler-Kefauver Act of 1950, tried to address the loopholes in the Clayton Act by placing laws around vertical mergers (when a company acquires a business in its source chain relatively than attaining a direct competitor) and mergers of conglomerates. Last but not least, in 1976, the Hart-Scott-Rodino Act put in location a rule that organizations arranging mergers about a selected benefit ($92 million for 2021) have to notify regulators and potentially facial area scrutiny just before they full their offer.

Switching scrutiny

All of the laws currently in put relating to evaluate of mergers place the stress of evidence in the exact same spot: on the regulator.

When firms file their pre-merger discover with regulators (the FTC generally the DOJ for large-profile, high-benefit, or notably difficult transactions), their paperwork basically suggests, “We’re heading to do this and this is wonderful.” The onus is on the regulator precisely to look for, determine, and most likely argue in court explanations why the proposed transaction could not be.

Klobuchar’s monthly bill would shift that load in the other route for firms that presently have a dominant marketplace place. All those companies—which in tech would totally contain corporations this sort of as Amazon, Google, and Facebook—would proactively have to demonstrate that a merger would not “build an appreciable possibility of materially lessening level of competition,” in addition to not building a monopoly or monopsony.

Mono-what?

A monopsony is properly the exact challenge as a monopoly—excessively concentrated market power—but inverted. As a substitute of there becoming only a person vendor, a monopsony is a condition in which there may well be several sellers but only a person consumer.

In a typical monopoly, you have only one seller accessible. For case in point, a single oil business has purchased all the oilfields and oil transportation providers and similar businesses in the nation, so if you want oil, you have to purchase it from that corporation. In the absence of competitors, that enterprise has no incentive to be adaptable in any way, including on value, and can successfully commit extortion not only on shoppers but also to other businesses up and down the source chain.

In a monopsony, you have only just one purchaser available—or a single major consumer at minimum has this kind of outsize marketplace ability that it by yourself can decide the way in which sellers function and what charges they can set. In the 1990s and 2000s, for example, Walmart was routinely criticized for forcing vendors to decreased price ranges to unsustainably lower thresholds. Walmart was ready to do so since it commanded these types of a superior share of the US retail industry that suppliers who desired obtain to people could not realistically refuse to operate with it.

In the tech room, a single could argue that Fb, Google, and Apple each individual at this time exert monopsony power in at least just one current market section. Amazon, for example, is so dominant in the bookselling room that publishers in essence cannot steer clear of the platform if they actually want to offer guides, and that presents Amazon leverage to established terms that might be unfavorable to publishers.

Though the initial regarded use of the word “monopsony” dates to 1933, no US antitrust law to day has at any time dealt with the strategy of anticompetitive actions from that form of bottom-up route. If it becomes regulation, Klobuchar’s invoice would be the very first to incorporate the risk of making a monopsony to the factors levels of competition regulators must contemplate when examining mergers.

And speaking of “anticompetitive”…

The invoice also expands the scope of what is thought of unlawfully lousy behavior on the portion of a dominant firm.

As we’ve described before, getting the biggest—or even the only—player in a sector is not by itself illegal. Level of competition legislation is in its place anxious with how you obtained there and what you do with the market ability that dominance offers you. Klobuchar’s proposal would grow that threshold and prohibit “exclusionary perform” that has an “considerable threat of harming level of competition.”

That sort of legal conventional could, for instance, have led to a distinctive outcome in the Qualcomm scenario, where by the Ninth Circuit reversed an before judge’s getting that the company behaved anticompetitively.

“These harms, even if authentic, are not ‘anticompetitive’ in the antitrust sense—at the very least not directly—because they do not require restraints on trade or exclusionary carry out in ‘the region of helpful opposition,” the court docket wrote in a commonly panned belief. Regulation that expands the definition of “exclusionary carry out” could lead to distinct findings in similar scenarios in the long term.

But will it at any time develop into regulation?

6 months or a 12 months ago, any antitrust reform proposal would have been useless in the water (as Klobuchar’s 2019 reform bill was).

With Democrats currently managing the White Residence, the Home, and—through Vice President Kamala Harris—the Senate, nevertheless, the strategy of reform really getting handed is a lot more doable. The wheels of Congress transform at about the amount of frozen molasses, of study course, and lawmakers on the Hill are currently prioritizing COVID-similar offers… but you can find ample totally free-floating anger at Large Tech each in the governing administration and in the nation at large that you will find a non-zero probability a invoice of this type could, certainly, have legs.