Get suggestions or a cost-free quotation for the insurance coverage you happen to be hunting for with CoverWallet. For much more data, examine out their web-site in this article.

The worst matter about economic recessions is that they’re unpredictable.

By the stop of August 2020, practically 100,000 firms discovered on Yelp forever shut up shop because of to the COVID-19 pandemic. As circumstances increased and limits turned more stringent all over the state and around the entire world, what adopted was an premature economic downturn no enterprise was geared up for.

The hallmarks of an financial recession include things like an boost in unemployment, a reduce in revenue, and a slump in purchaser paying out. It has a trickle-down effect that can economically hurt everyone indirectly, but small corporations are generally the kinds strike toughest during a credit rating crunch. When buyers slice back again on paying out to compensate for layoffs, spend cuts, or furloughs ensuing from a recession, a business’s earnings stream narrows as the present also slows down.

Massive-scale firms can control to cushion the downturn due to the fact they have deeper funds reserves and economical leverage to borrow money from banks (while paying out off these money owed is an entirely different tale). On the other hand, modest businesses typically have neither the leverage nor funds to maintain by themselves to bear the brunt of an economic drop.

How Business Insurance policy Protects Your Property

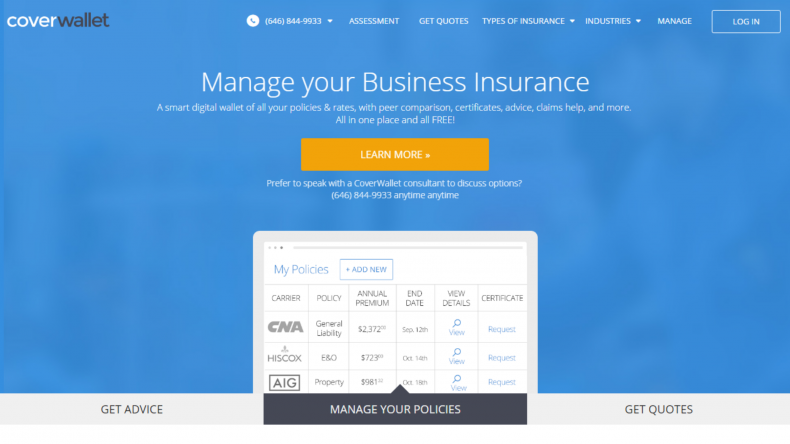

your company belongings from chance and unforeseen liabilities to prevent incurring avoidable losses in the midst of a downturn. Select the insurance policy for your company with CoverWallet – a foremost company of threat remedies for smaller to medium enterprises (SMEs).

CoverWallet helps make it uncomplicated for smaller enterprises to opt for the appropriate insurance fit for their size and business in mere minutes to get you back to handling your organization and serving your clients. Normal Liability Insurance coverage, Assets Insurance, Workers’ Compensation Insurance policies, and Small business Interruption Insurance are just some of the necessary coverages any organization desires to prosper and endure in any overall economy. If you require even further assistance, their CoverWallet consultants can support you slender down your possibilities.

With a quick evaluation of your enterprise, CoverWallet can supply you with offers on all the types of insurance policies they present SMEs. With the appropriate protection, your small business may well just deflect any curveballs thrown your way.

How A Economic downturn Impacts A Modest Enterprise

To give you an concept of what SMEs have to endure throughout a recession, read through on:

Decreased Funds Circulation

Since small corporations do not have a ton of hard cash methods to depend on, their income stream is closely monitored to see how a great deal dollars comes in and how a lot goes out. As very long as the dollars circulation cycle keeps churning, it is really very good for enterprise. But what transpires when predicted funds-ins get delayed, as is the situation in a economic downturn? The final result is a chain reaction of late payments from equally consumers and sellers waiting for money to arrive.

Credit rating Impairment

When cash flow is minimized, it may well not make up for the accounts payable that the enterprise owes. As this sort of, payments for payments, expenses, and other expenses are delayed or compensated off incrementally, but given that these modes of payment really don’t live up to primary credit history agreements, these can lessen your business’s credit rating. More importantly, the decreased your credit score score, the considerably less probable your enterprise can attain financing when needed.

Reduction of Demand from customers

In a economic downturn, buyers develop much more cautious with their paying, cutting back on charges and prioritizing requirements to extend their money as significantly as doable. Depending on your business’s industry, customers could look at your merchandise or provider a low priority, which inadvertently decreases desire for your business. For individuals who depend on a handful of main purchasers, a chunk of income can quickly be minimize when a person or a lot more of them make your mind up to slash back on shelling out.

Lay-Offs

When there is certainly a loss in need and profits in a little company, this can lead to money constraints to keep functions. Fork out cuts may well be available to personnel and management to deliver some respiration area, but if individuals are not plenty of of a compromise, it might guide to laying off staff instead. Even though it truly is fairly less difficult to lessen your staff than to get your company out of rental contracts, this choice is one particular of the most challenging types to make, largely since you’re working with the human side of the organization.

Other Budget Cuts

The for a longer time a recession performs out, the a lot more constricted a little small business becomes in acquiring hard cash reserves and other revenue streams to survive. This sales opportunities to more budget cuts, and a person of the 1st charges that are dropped is marketing and advertising. It would not be a lot of a loss for some businesses, especially if they give a exclusive products or service with tiny to no level of competition but for some others, it could be a challenge to faucet new marketplaces and entice new customers.

Get information or a free quotation for the insurance policy coverage you’re searching for with CoverWallet. For extra information and facts, check out out their website listed here.

We could gain a commission from one-way links on this site, but we only advocate items we back. Newsweek AMPLIFY participates in numerous affiliate marketing systems, which implies we may get paid out commissions on editorially picked products procured via our inbound links to retailer websites.