Butterflies Are Absolutely free: This GameStop Solutions Perform Is Barely Ever Seen

I am beating a lifeless horse on Twitter. I am beating it in this article. Why? Due to the fact right now, you are observing a little something you practically never ever see in the markets. Ever.

The selections marketplace is so mispriced in the July far out-of-the-money put contracts on GameStop (GME) that you can lock in a risk cost-free rate of return in the 20% to 40% variety between now and July.

Now, how can something chance-totally free have a mentioned level of return? I am happy you questioned. The motive has to do with acquiring electrical power.

We’re likely to use an instance. In this case, I am talking about the July 21, 2021 GME $3 – $2.50 – $2 place butterfly.

In this trade, you would be long a single $3 put, quick two $2.50 puts, and prolonged one particular $2.00 set. That leaves you extensive two places and short two places. Your danger on that particular trade is only what you pay back for it, but there is a catch in obtaining electrical power.

The trade is divided into a prolonged place unfold $3 – $2.50 and a brief put spread $2.50 – $2.00. That quick set unfold will tie up $50 in purchasing ability moreover your value. So, even with your risk remaining minimal to your entry price tag, there is continue to a getting energy tie up. Ironically, this later swung to the $4 – $3.50 – $3.00 for the optimum return, so a trader could have double-dipped.

This is where by these days will get interesting.

This specific trade has been paying a Net credit. Keep in mind, our chance was our cost to enter having said that, we are finding compensated to enter. That suggests our hazard is basically higher than zero. The worst-case end result is the internet credit rating gained on in the beginning creating the trade.

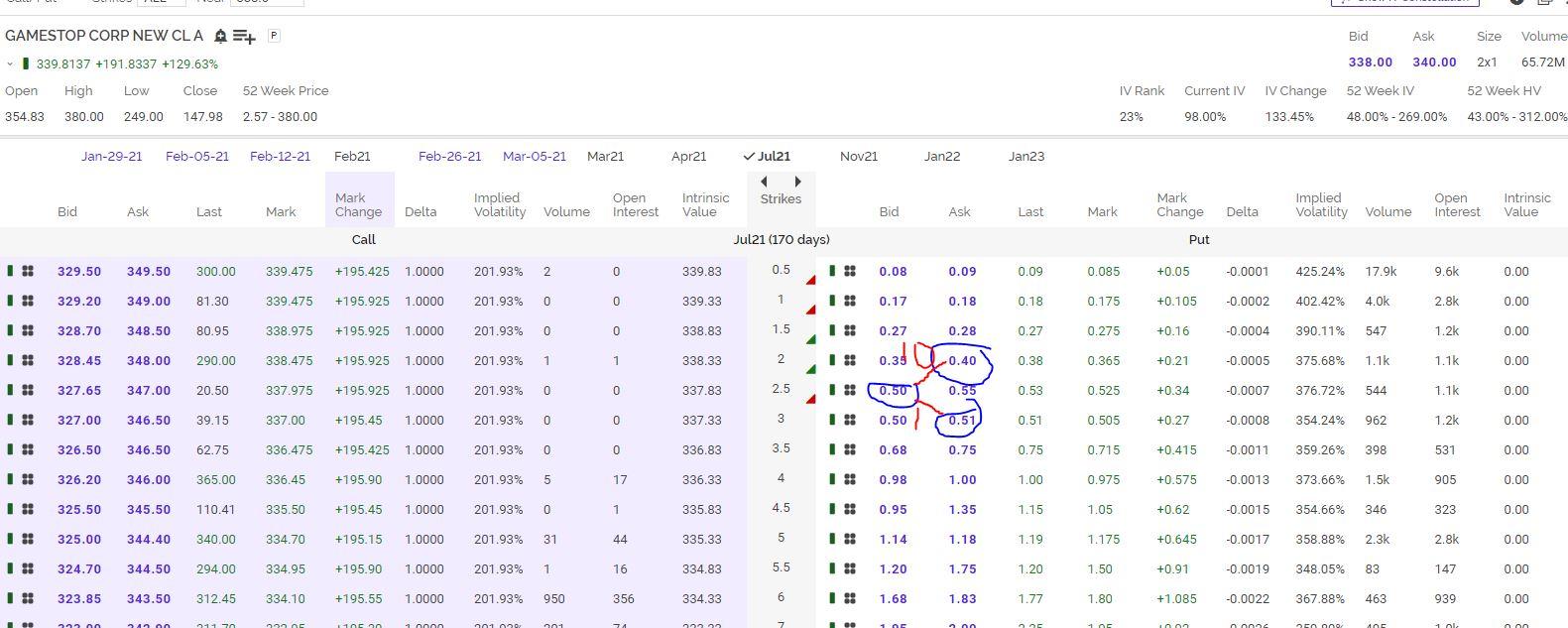

Let’s stroll as a result of this display shot, above.

Here, we can buy the $3 place for $51. We then market two $2.50 places for $50 each, bringing in $100. Future, we buy the $2 set for $40. General, I spent $91 ($51 + $40) and I gathered $100. That’s a $9 internet credit. This impacts my shopping for electric power $50 considerably less than $9 received, so $41 all round. That implies, between now and July, I will make a return of $9 on my $41, or 22%. If the stock falls to $2.50 (doubtful), that could raise to $59, but as long as I close this on expiration, I’ll wander with $9 fewer commissions.

About lunchtime the $4 – $3.50 – $3 set butterfly paid out a internet credit as significant as $20! So, $20 from $30 of obtaining electrical power and now danger. I am going to choose a 66% hazard-absolutely free price of return in 6 months anytime.

The crucial place is what to search for in this scenario. I signify, telling individuals about the trade following-the-point does tiny great, so how do you spot these?

For now, I’m searching at the alternative chain. What I want to see is a skew. In this situation, I observed the bid price on the $2.50 place was extremely shut to the question value on the $3 place. They were only a penny apart. Though the bid on the $2.50 was a dime above the $2 ask. Usually, this is reversed. So, when I see the leading amount (the crimson variety “10” I have drawn) is bigger than the bottom selection (the crimson range “1”), I straight away know I want to go soon after this trade.

That is the math you need to have to do. You are seeking for skews like the a person in this article. It takes a small observe. The tighter the butterfly, the less complicated it is to see with the naked eye. In this situation, they are all one strike aside. If you attempt to glimpse at the $5 – $3 – $1, you have more substantial numbers to deal with and more strikes in amongst. It’s straightforward to make a mistake. Consider of it like climbing a ladder. It really is quick to go just one stage at a time. The much more steps you test to just take, the extra vulnerable you are to an accident.

In limited, what you are looking for is the inquire on the highest priced strike to be close to the bid on the middle strike and the bid on the center strike to be a great deal much larger than the check with on the lowest cost strike. I circled them earlier mentioned. When I see .51 – .50 – .40, you can see it stands out. This we want! The difference in between the first two quantities is noticeably less than the big difference involving the very last two figures.

If it have been .51 – .41 – .40, you wouldn’t contact it. Listed here the distinction involving the to start with two is larger than the difference involving the second two. At that point, you would shell out $11 for the set spread relatively than pay $10 for a butterfly.

I’m not arguing this is an straightforward notion to do with the bare eye, but it is doable.

Just one other detail to think about: You might have to leg into the trade, which implies accomplishing all the strikes individually. That is a definitive possibility. In that occasion, I do them items at a time and will check out to have orders completely ready at the exact time. This is why I aim on working with the bid and the ask. As prolonged as I do not test to oversize or things my full posture at as soon as, I should really get execution. I could possibly even get far better execution than the inquire on the purchase and the bid on the market, but if I price tag primarily based on the bid-check with and I even now have some cushion, then I should really wander away with a profitable system.

Get an e-mail inform every single time I produce an posting for Authentic Revenue. Click on the “+Follow” subsequent to my byline to this report.