At 18 lakh, motor vehicle income crash to 10-calendar year low in April-December

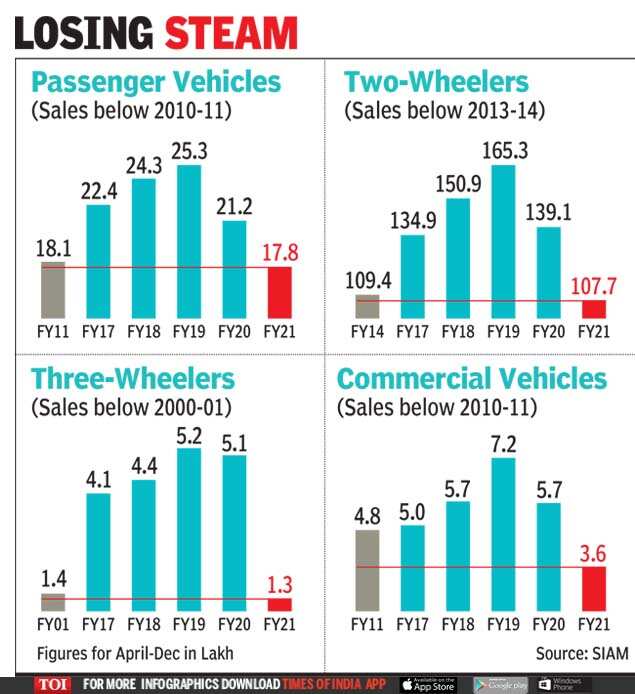

In accordance to figures introduced by market entire body Siam, profits of passenger automobiles — a cumulative of automobiles, SUVs, MPV/UVs — stood at 17.8 lakh units in April-December, the cheapest in a 10 years due to the fact the 18.1 lakh models bought in the very same period of time of FY11.

Two-wheelers profits in 9 months of this fiscal stood at 107.7 lakh models, cheapest due to the fact 109.4 lakh models found in 2013-14. 3-wheelers revenue stood at 1.3 lakh models. In 2000-01, the sector marketed 1.4 lakh units.

In professional automobiles, the volumes stood at 3.6 lakh models (final cheapest at 4.8 lakh units in fiscal 12 months 2010-11), and contraction in this article obviously points out that the broader financial state is even now in deep difficulty, and lacks assurance.

“The sector has to do the job challenging to get to improved volumes and superior business enterprise,” Kenichi Ayukawa, MD of Maruti Suzuki, who is also the president of Siam, reported.

Ayukawa reported that desire has been coming back again, which was obvious through gross sales over the earlier couple months, but added that it is also early to contact it a turnaround. There has been a scarcity of vital parts these kinds of as semiconductors and also the coronavirus problem still persists even even though vaccination travel will be beginning soon.

“The income progress that we noticed through the third quarter of the present fiscal has some of the pent-up demand from the 1st quarter. So, the standalone gross sales overall performance of the third quarter may not be a true reflection of the industry’s all round product sales,” he reported, introducing that some far more time is demanded to make a truthful evaluation of in which the sector is headed for.

“The sector is experiencing a shortage of semiconductors, metal and other elements. These may guide to source and manufacturing disruptions. There is also an affect of the cost increase of steel, logistics and other raw supplies. In these types of form of fluctuations, it is quite tricky to forecast the demand from customers scenario likely ahead.”

Asked about his expectations from the forthcoming Finances, Ayukawa mentioned the market awaits the introduction of the scrappage policy, which would enable weed out older polluting cars by incentives.

Nevertheless, he reported there is no instant will need for a GST rate cut and this stays a medium- to lengthy-term request. “We can fully grasp the authorities has major obligations and restricted resources as of now. So, presently we are not pushing for a GST reduction.”