Apple Stock This Week: Earnings About The Corner

Apple earnings preview: Can products and services double yet again?

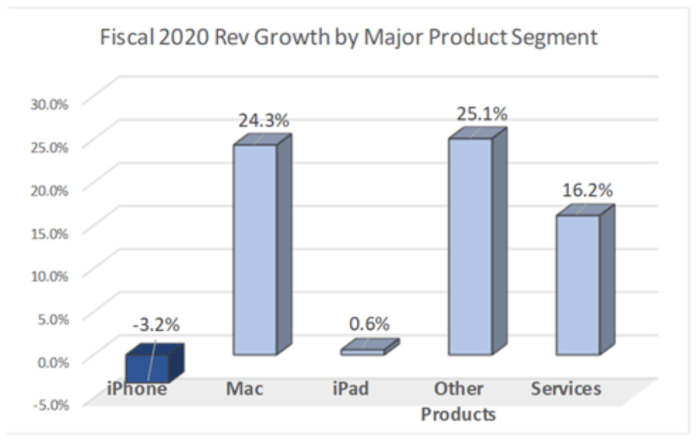

Apple’s solutions segment had a strong fiscal 2020, and the getaway quarter is unlikely to be any different. Revenues elevated 16% (see graph under), pushed by favorable continue to be-at-property developments.

Initial take a look at for Apple A person

This will be the very first quarter in which the good results of Apple One particular will be tested. I suspect that the benefits will be satisfactory, to say the minimum.

The bundles may possibly be Apple’s alternative to delicate demand for some of its much less well known and a short while ago launched companies., which involve Information+, Arcade and Fitness+. This would be in line with my authentic choose on Apple A single:

“Apple’s 1 services bundle is all about nudging end users to not only signal up for solutions that most want (Songs, iCloud), but also for these that most men and women hardly ever believe about (News+, Arcade). In my look at, this could be the option to the lack of traction problem viewed in elements of Apple’s companies choices.”

Why Jim Cramer likes Apple right here

On Friday, ahead of the Martin Luther King Jr. holiday break, The Street’s Jim Cramer weighed in on Apple. He briefly argued that the stock was a “terrific buy” at present selling prices.

Supporting his position are the subsequent couple of factors:

- Demand from China is a great deal much better than earlier imagined, which include in Mac and Services.

- Shares are down about $10 from the late December peak, featuring some worth to newcomers.

China is searching wonderful

Jim Cramer is likely right about the China possibility in the getaway quarter.

3rd party details implies that Apple accounted for in excess of 20% of smartphones marketed in the region in the fourth calendar quarter. This is an remarkable amount, considering how domestic players are inclined to dominate this current market.

Is less costly “cheap enough”?

On the 2nd point, Jim Cramer is also appropriate: Apple is now less costly than it was a mere a few months back. But no matter if “cheaper” is “cheap enough” is yet another issue altogether.

Keep in intellect that Apple inventory has been up 63% in the previous year and 424% in the earlier five. From this point of view, shares are now significantly from discounted.

On December 29, particularly when the stock attained its the latest all-time higher, the Apple Maven posted a rapid review on Apple’s valuation. The details suggested overvaluation back then.

Cost-earnings ratio of about 42 occasions was substantially increased than all through any other period of time prior to 2020. Relative to the S&P 500’s P/E numerous, Apple’s valuation high quality was the widest that it has been due to the fact 2012 at least.

Microsoft earnings overview: What will subject most

The Apple Maven appears all over the FAAMG group to preview Microsoft’s earnings report. Anticipate the company to defeat consensus, as usual, supported by cloud and personalized computing.

What Wall Avenue expects

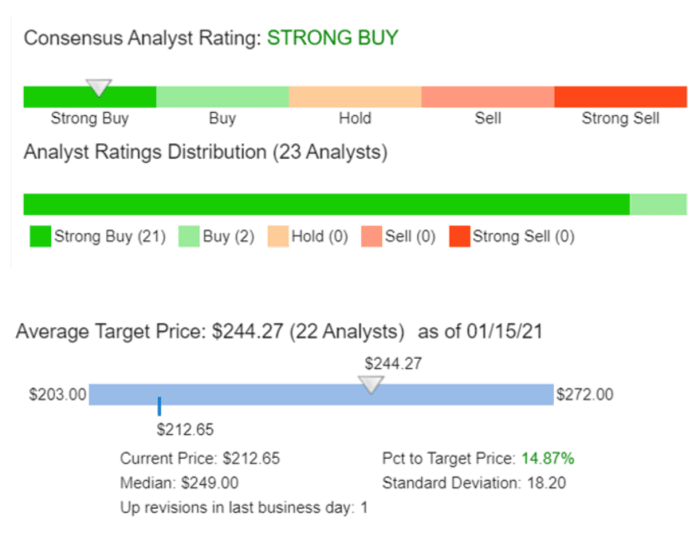

First, let us get a peek at what analysts have been saying about Microsoft. According to Stock Rover, the consensus opinion is that Microsoft is a powerful purchase, with pretty much all investigate retailers agreeing on the bullish ranking (see chart beneath).

Median cost focus on on the inventory is at this time $249 for each share. At these concentrations, Microsoft would have 17% upside opportunity.

The Apple Maven’s look at

Microsoft is recognized for promising minimal and providing perfectly beyond its outlook. The final time that the enterprise unsuccessful to defeat consensus estimate on earnings was all the way back in early 2016. As a result, do not be stunned to see one more much better-than-predicted set of numbers this time.

Apple stock: What analysts are saying ahead of earnings

Apple’s earnings day is quick approaching. In advance of it, Wall Street has been weighing in on the company’s fundamentals and the inventory. Not all viewpoints, even so, have been bullish.

Largely bullish…

The last handful of research notes coming from Wall Avenue have been mostly upbeat about Apple’s prospective buyers in the new year. RBC Capital’s Robert Muller was the most latest a single to reiterate his obtain on the inventory and his rate concentrate on of $145 for each share.

Even greater than that, a couple of experts have raised their targets on Apple ahead of earnings. This was the scenario of Loop Money analyst Ananda Baruah, whose truthful worth estimate increased from $131 to $155 apiece, pointing at 20% upside prospect on the back again of “a genuinely big year” for the Iphone and Mac.

Barclay’s Tim Extensive bumped his goal selling price to $116 per share from $110, but kept his equivalent-excess weight recommendation.

… but a word of warning

The bearish warning of the week was sounded by Goldman Sachs analyst Rod Hall. He retains a single of the handful of sell ratings on Apple, with a selling price focus on of $85 suggesting about 35% downside threat.

Mr. Hall’s key issue lies with the Apple iphone. Alternatively than a “super cycle”, he thinks that 2021 will deliver about a standard redesign cycle. He sees the substitution amount in decrease, and thinks that the detrimental trends will persist in the course of the 12 months.

Apple’s AR and VR devices: The up coming significant matter?

The rumor mill is churning after yet again, with Apple’s new VR and AR devices speculated to strike the marketplace in the future handful of many years. Will they be the Cupertino company’s following massive thing?

What are we looking at?

According to Bloomberg, “Apple is setting up to launch an pricey, niche digital actuality headset ahead of its commonly rumored AR good glasses. The first model will be so high priced that just about every Apple Keep may well only market a single each individual day”.

Apple’s wearable machine would not be novel the identical way that the Iphone was a pioneer in the smartphone classification. At the moment, the likes of HTC, Sony and Fb presently compete in the VR space with equipment like the Oculus.

The Apple Maven’s impression

I am considerably less enthusiastic about a different VR headset hitting the industry than I am about an “Apple Glass” staying launched someday before long.

I believe that, even so, that the to start with corporation to go to market place with a aggressive product that brings together excellent and accessibility will have a massive edge in the shopper IT hardware field for the next 5 to 10 decades, at least.

Browse more from the Apple Maven:

(Disclaimers: the writer may perhaps be very long one particular or far more stocks pointed out in this report. Also, the report might contain affiliate backlinks. These partnerships do not influence editorial content material. Many thanks for supporting The Apple Maven)